Frequently Asked Questions

About Municipal Utility Districts:

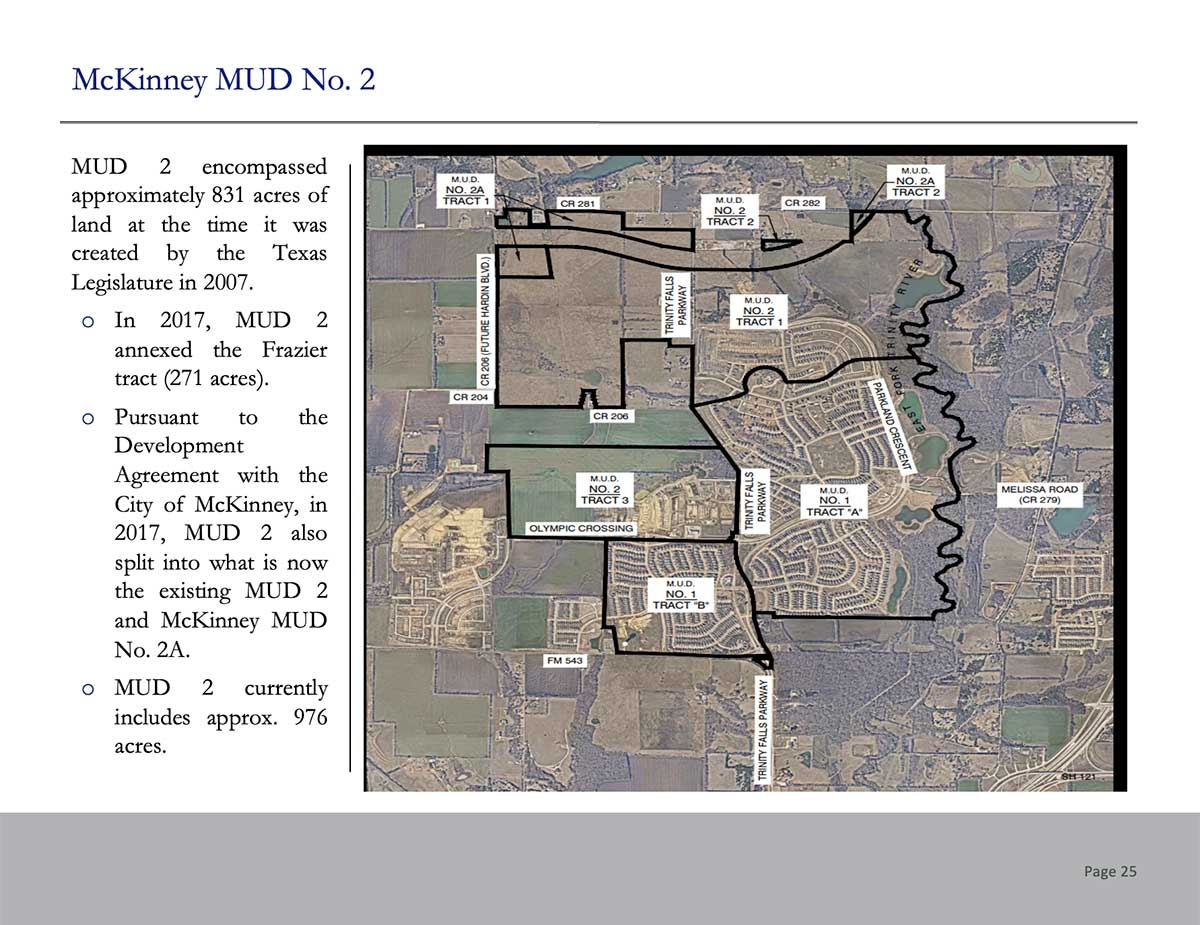

A municipal utility district (“MUD”) is a political subdivision of the State of Texas authorized by the Texas Commission on Environmental Quality (“TCEQ”) to provide water, sewage, drainage, roads and other utility -related services within the boundaries of the MUD. When a plan is created to develop an area of land which does not fall within a City’s boundary, a MUD can be created to allow for the payment of costs related to planning, excavation and installation of water lines, sewer lines (both sanitary and storm), drainage facilities, roads, utility services, etc. The cost of this new development is not shouldered by taxing the existing residents of the City of McKinney. The debt is paid for by the residents who choose to live within the MUD and use the public facilities. MUD 2 is not within the boundaries of the City of McKinney. It is in the City’s extraterritorial jurisdiction (“ETJ”). Because MUD 2 is within the City’s ETJ the City’s subdivision regulations are applicable to the land developed within MUD 2. MUD 2, along with McKinney Municipal Utility District No. 1, encompass the Trinity Falls residential community.

MUDs vary in size, but they generally serve master-planned communities of a few hundred households. In the Dallas-Fort Worth Metroplex, Light Farms, Castle Hills, Savannah, Paloma Creek and Harvest are all communities with their own special district, just to name a few. Overall, Texas has more than 2,000 special districts, many of which are located outside of city limits where there are no municipal services.

Trinity Falls was originally designed for 4,200 homes at full build-out over the 1,702 acres of land. Johnson Development purchased an additionally 270 acres in 2017 which was annexed into MUD 2, and the latest number of homes is estimated to be approximately 5,400.

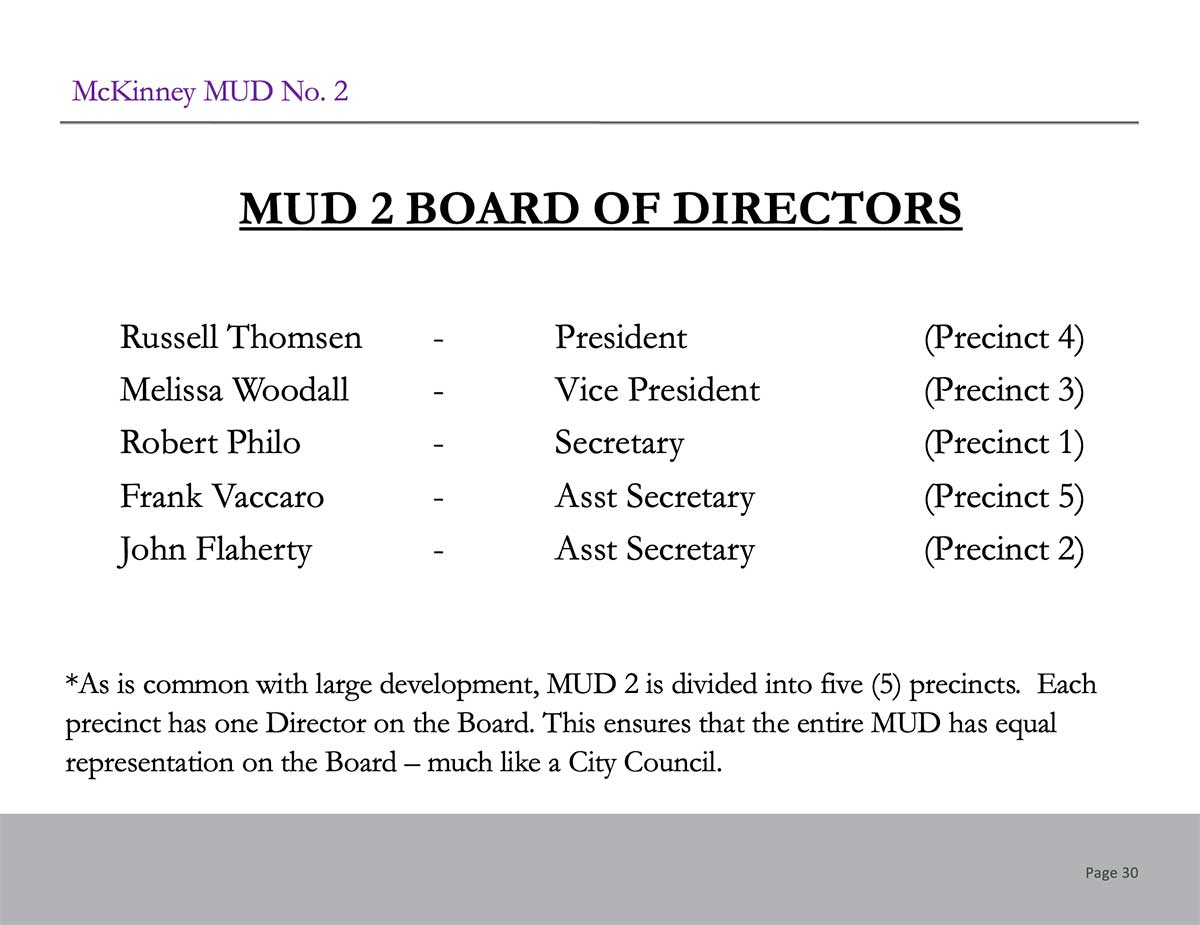

When a MUD is proposed and approved, by either the TCEQ or the Texas State Legislature, five appointed members serve as the Board of Directors, with staggered 4-year terms. These individuals (who typically volunteer to be appointed) cannot be an employee of, or in any way be associated with, the developer.

- The Board of Directors manages and controls all of the affairs of a MUD, subject to the rules and regulations stipulated by the State Legislature with on-going supervision of the TCEQ.

- The Board establishes policies which are in the interest of its residents and utility customers, while abiding by the above-listed rules and regulations.

- A MUD may adopt and enforce all necessary charges, fees, and taxes necessary to provide district facilities and services.

As is common with large development, MUD 2 is divided into five (5) precincts. Each precinct has one Director on the Board. This way the entire MUD has equal representation on the Board – much like a City Council.

The current precinct representation is as follows:

Precinct 1 – Robert Philo

Precinct 2 – John Flaherty

Precinct 3 – Melissa Woodall

Precinct 4 – Russ Thomsen

Precinct 5 – Frank Vaccaro

Each precinct is represented by one Director who holds one vote on the Board of Directors. CLICK HERE to view the MUD 2 precinct map.

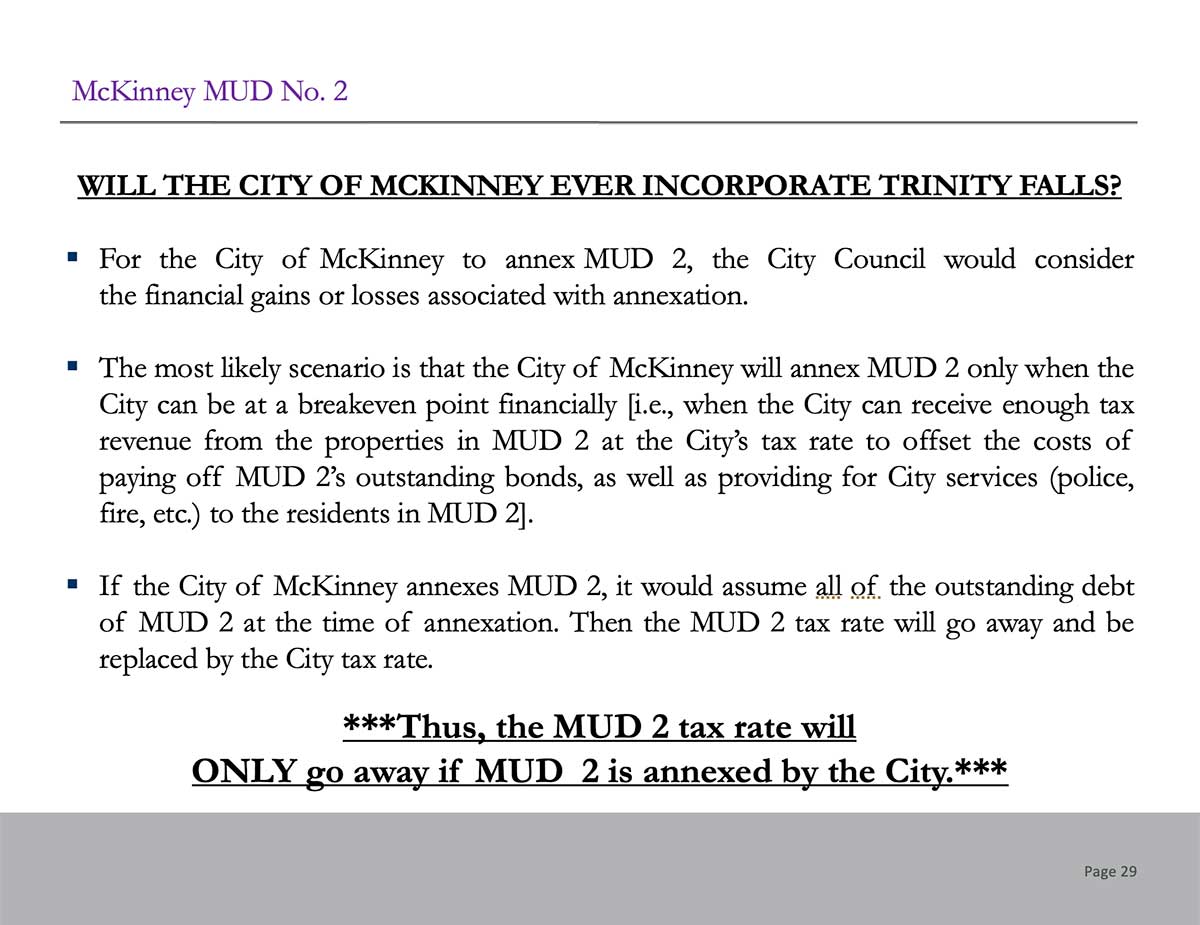

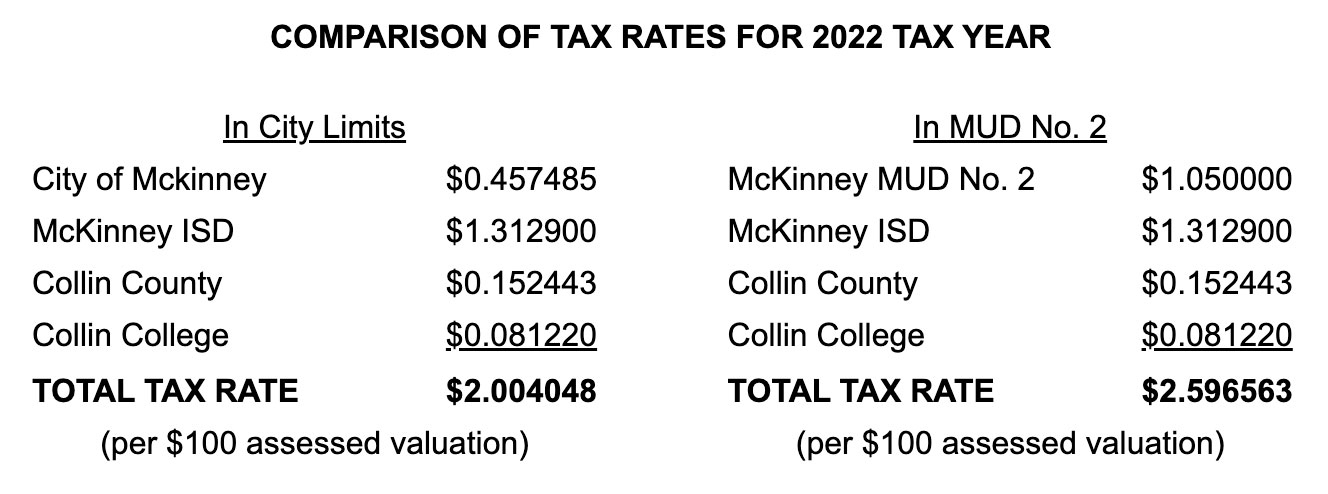

For the City of McKinney to annex MUD 2, the City Council would consider the financial gains or losses associated with that expansion. If the City of McKinney were to annex MUD 2, the City would be required to pay off all the indebtedness accrued by MUD 2, which it incurred to finance all infrastructure projects within MUD 2.

The most likely scenario for the City of McKinney to annex MUD 2 will be only when the City can be at a breakeven point financially. In other words, when the City can receive enough tax revenues at the City’s tax rate, generated by the MUD 2 to offset the cost of paying off the MUD 2 debt. Therefore, until it becomes financially sound for the City of McKinney to take that on, it likely will not happen anytime.

If the City does decide to annex MUD 2, then the MUD 2 tax rate will go away and be replaced by the City tax rate. Thus, the MUD 2 tax rate will ONLY go away if MUD 2 is annexed by the City.

Developers must petition the TCEQ or have a bill filed with the Texas Legislature to create a municipal utility district (MUD). Developers are prohibited from serving or placing employees, business associates, or family members on the MUD Board of Directors.

The laws relating to voting differ for an HOA and a MUD. In a MUD, only registered voters living within the boundary of the MUD (or MUD Precinct) may vote in an election. Thus, developers cannot vote in a MUD election and have no authority or control over the MUD Board of Directors.

Because a MUD generally has no funds available prior to development and the cities are unwilling or unable to extend utilities to land outside their boundaries, the Board of Directors of the MUD will enter into a reimbursement agreement with the developer that requires the developer to finance 100% of the costs of all public utilities and infrastructure within the District. Then, once there are enough homes or other improvements constructed by the developer and there is sufficient taxable value in the MUD, the MUD financial advisor will recommend that the MUD issue bonds to reimburse the developer for the costs of the public infrastructure and/or facilities.

Before the bonds are issues and sold: (1) the TCEQ will review and approve a bond application submitted by the MUD in order to confirm that the issuance of such bonds is “feasible” in accordance with the TCEQ rules, (2) the Attorney General of the State of Texas must review and approve the transcript of proceedings in connection with the bond issue, and, (3) an independent third-party auditor must issue a report verifying that the developer is due the reimbursement request.

MUD 2 has already issued both utility and road bonds in 2021 and 2022. We anticipate issuing both types of bonds again in 2023.

In addition to their common function of roads, water, sewer, and drainage service, MUDs are legally empowered to engage in conservation, irrigation, electrical generation, firefighting, solid waste collection and disposal and recreational activities (such as parks, swimming pools and sports courts). A MUD can provide for recreational amenities when approved by the Board of Directors and funded by the MUD through their annual budgeting process. Only districts in certain Texas counties can issue bonds for park and recreation amenities. Collin County is not one of those counties, so MUD #2 cannot issue bonds to finance any park and recreational facilities.

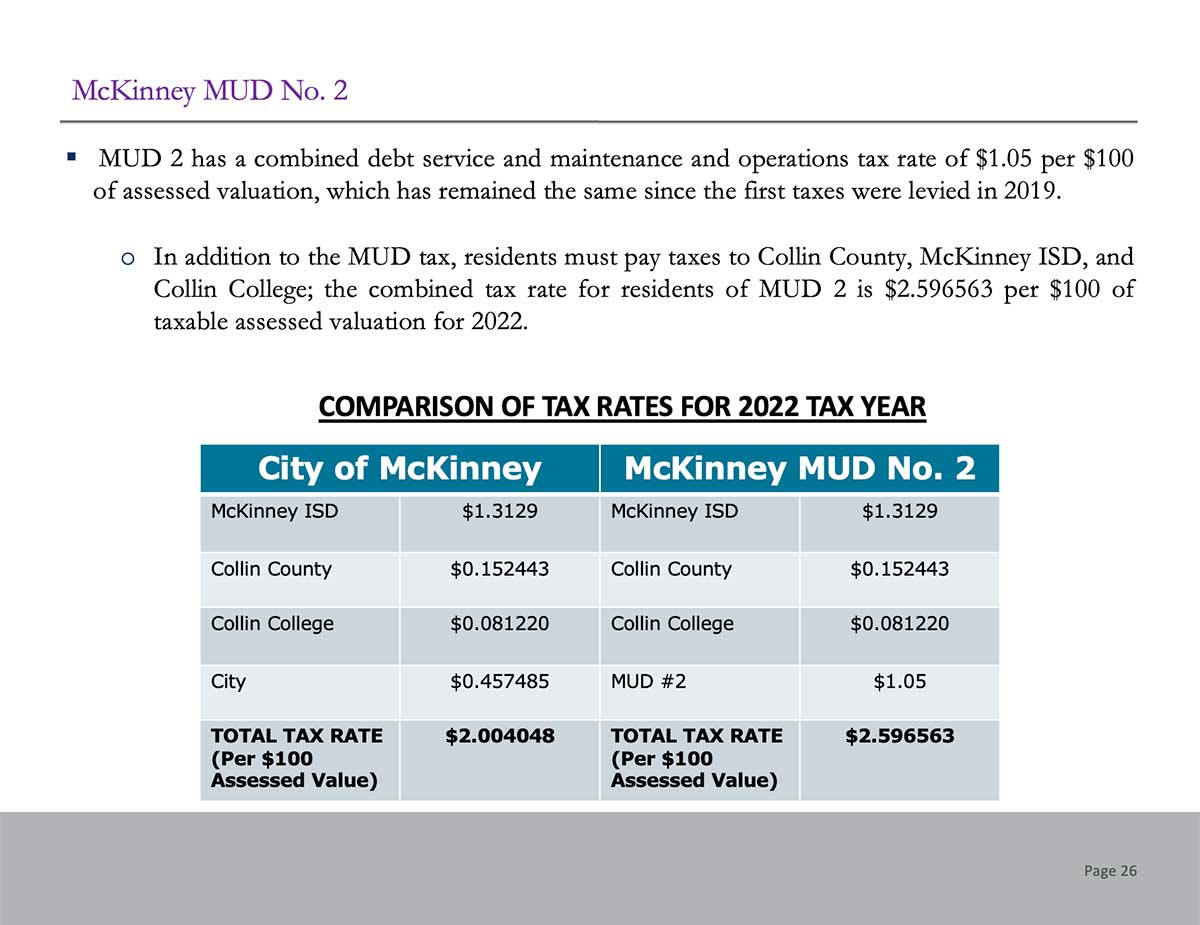

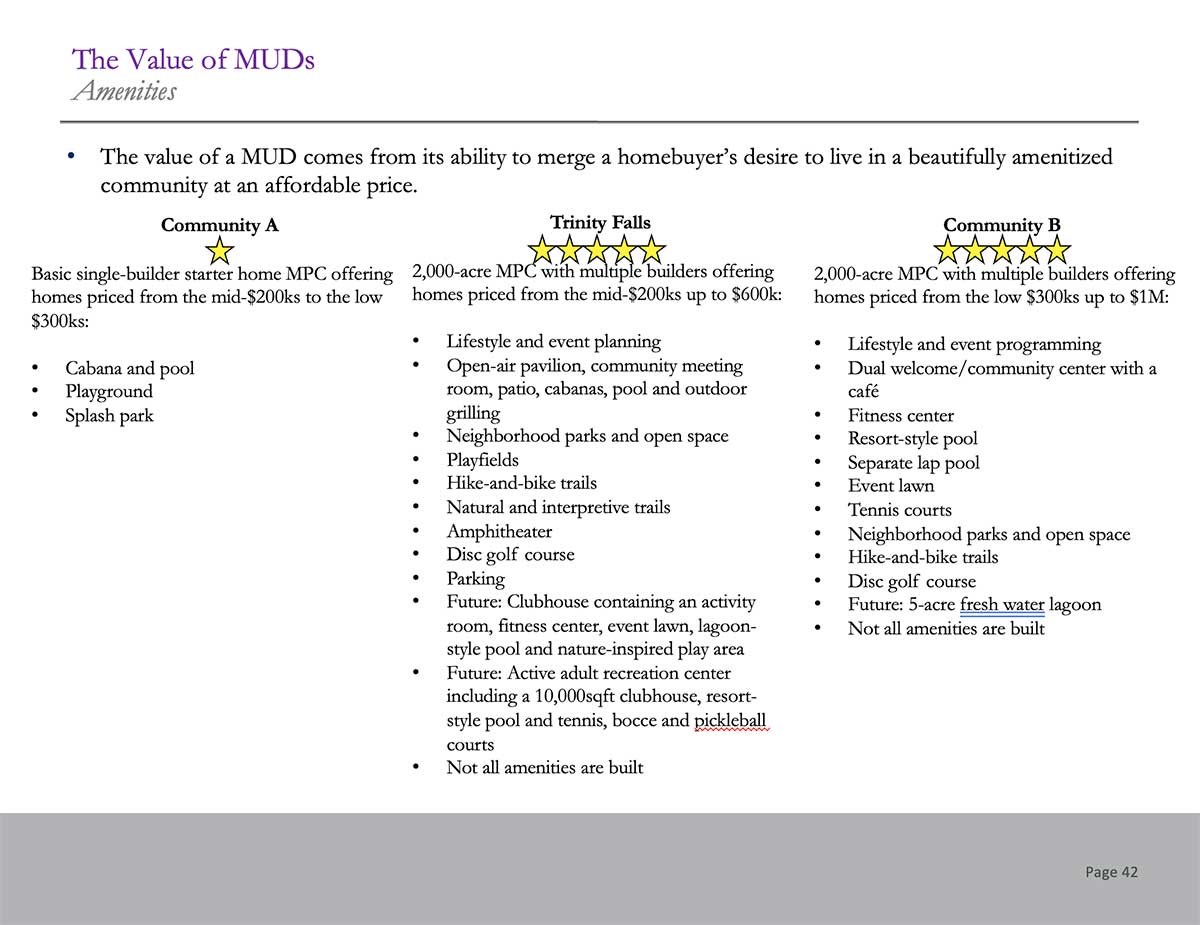

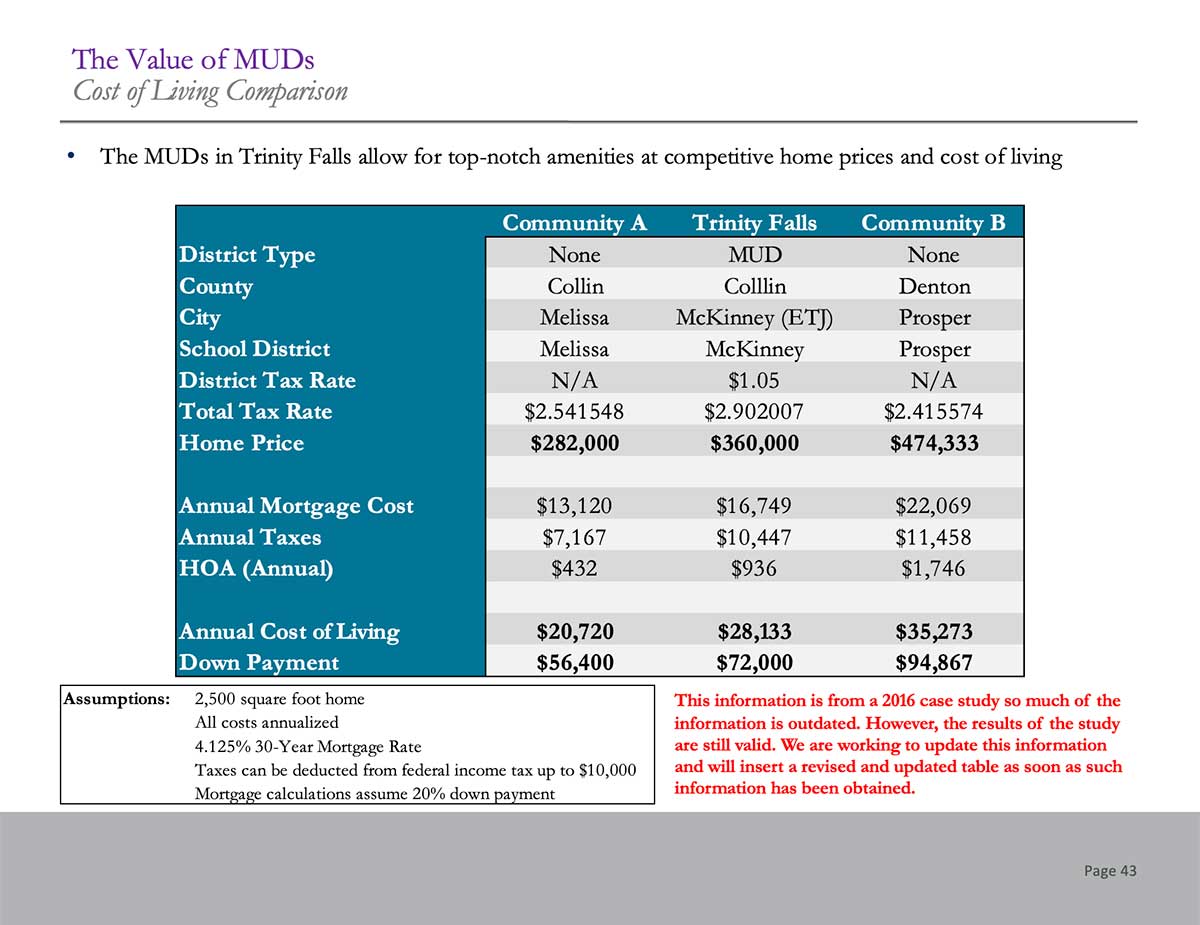

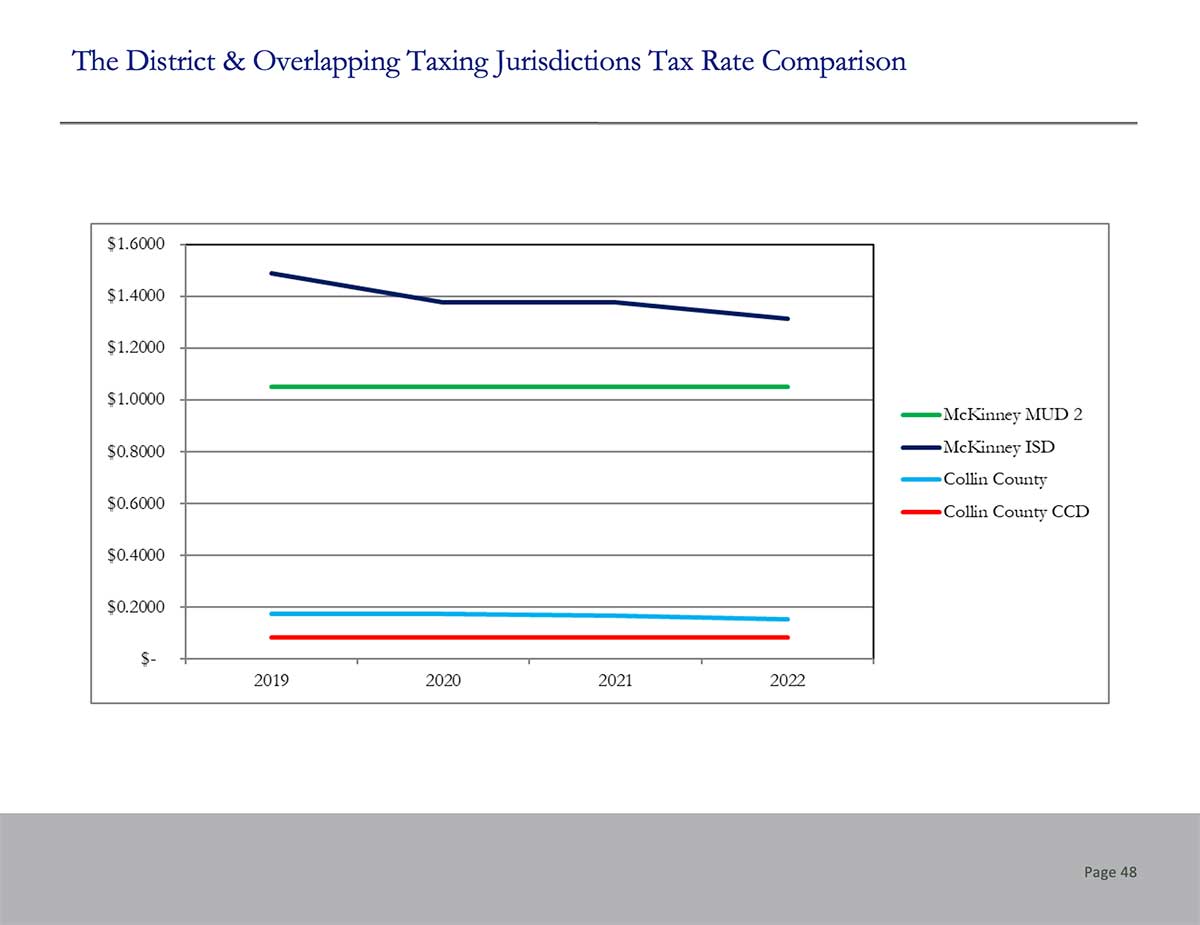

By choosing to live in a MUD District, we all recognize that we pay higher taxes than if we lived within a municipality such as the City of McKinney. We still get to enjoy all the amenities of our close proximity to McKinney, yet, we live in a developing MUD within Trinity Falls – a dynamic, beautiful, natural and diverse community of households. By choosing to pay a little more, we all get to enjoy new streets and infrastructure, amenities that are easily accessible to all, a wide variety of trails, lakes and other recreational assets and a higher-quality of municipal features such as streetlights, street signs, etc. The MUD provides for new quality development of infrastructure upon which new quality homes are built and families call home.

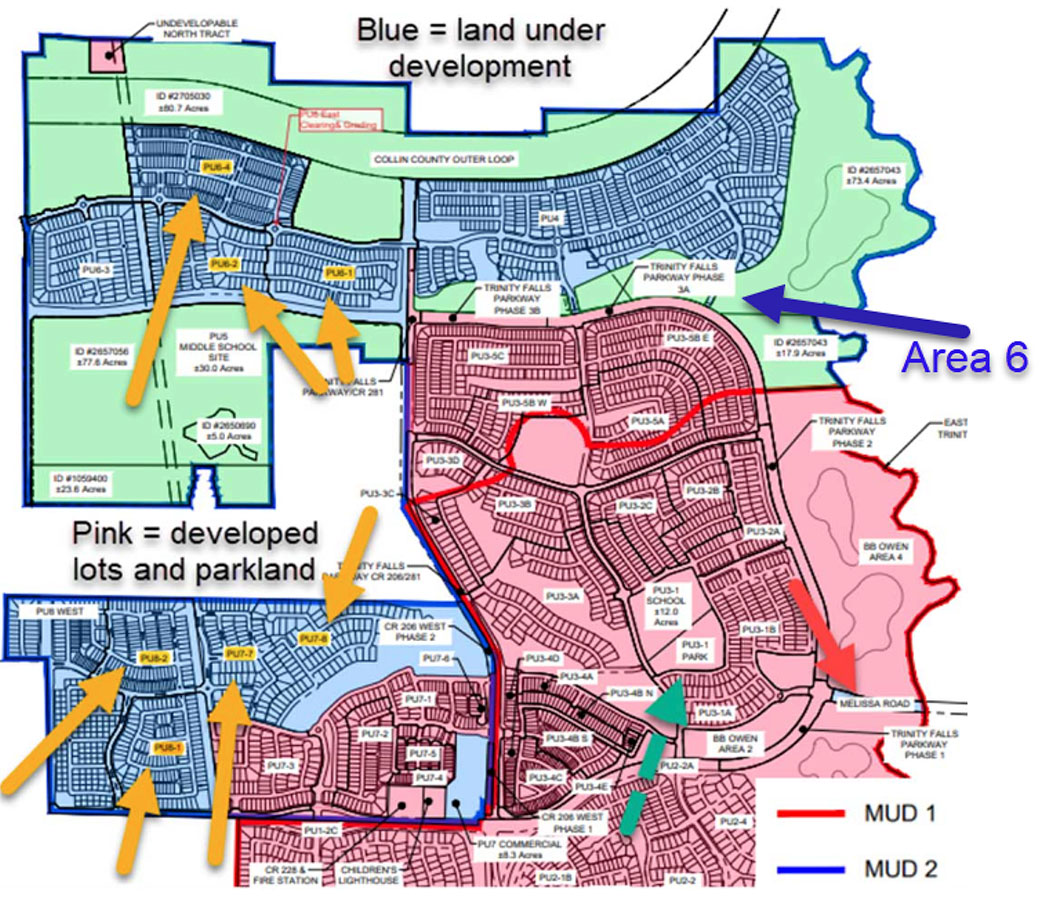

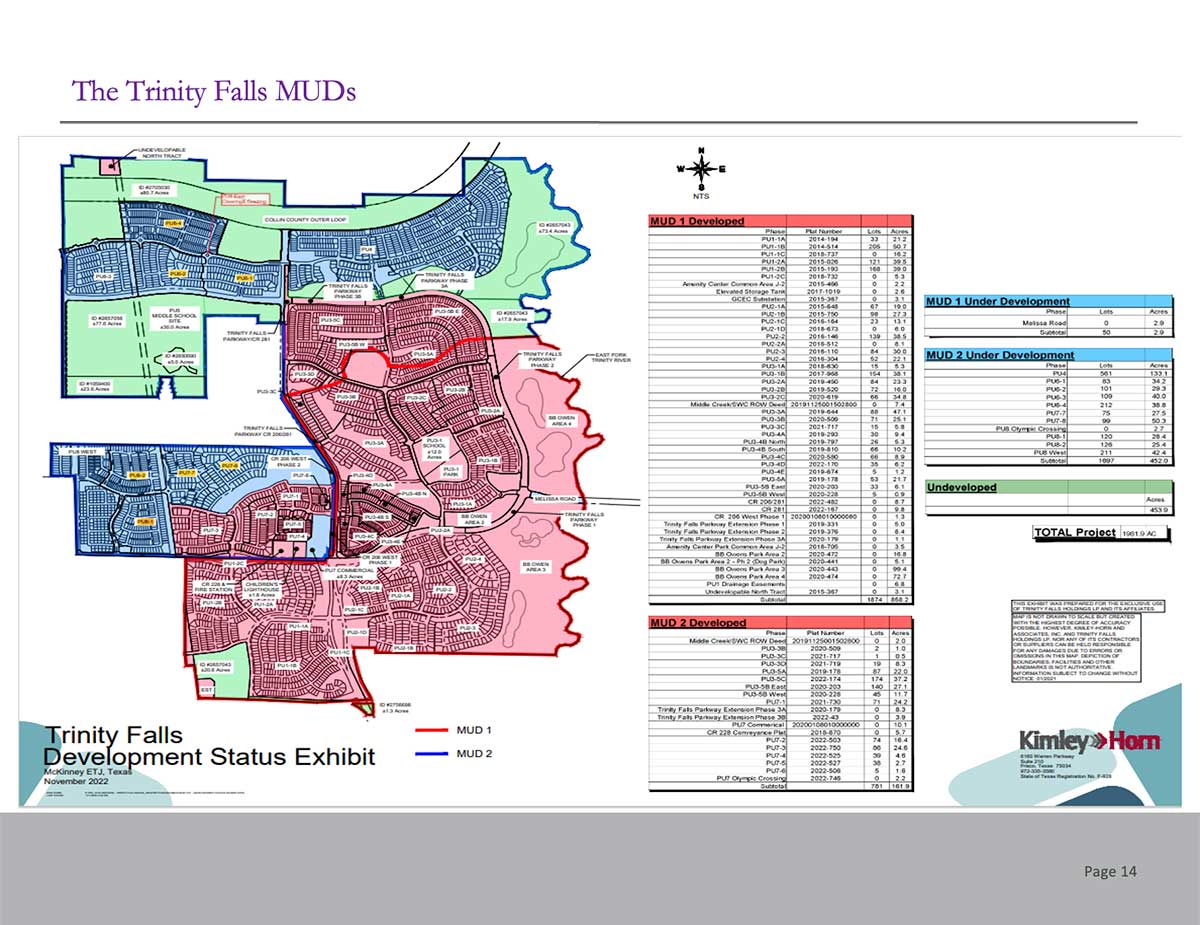

Projected Lot Deliveries

- PU7-7 (73 lots) 3Q23 (Location highlighted gold on map)

- PU7-8/CR 206 W Ph 2 (100 lots) 1Q24 (Location highlighted gold on map)

- PU8-1 (126 lots) 2Q23 (Location highlighted gold on map)

- PU8-2 (117 lots) 3Q23 (Location highlighted gold on map)

PU6 East Clearing & Grading (Location highlighted gold on map)

- The contractor is currently moving dirt.

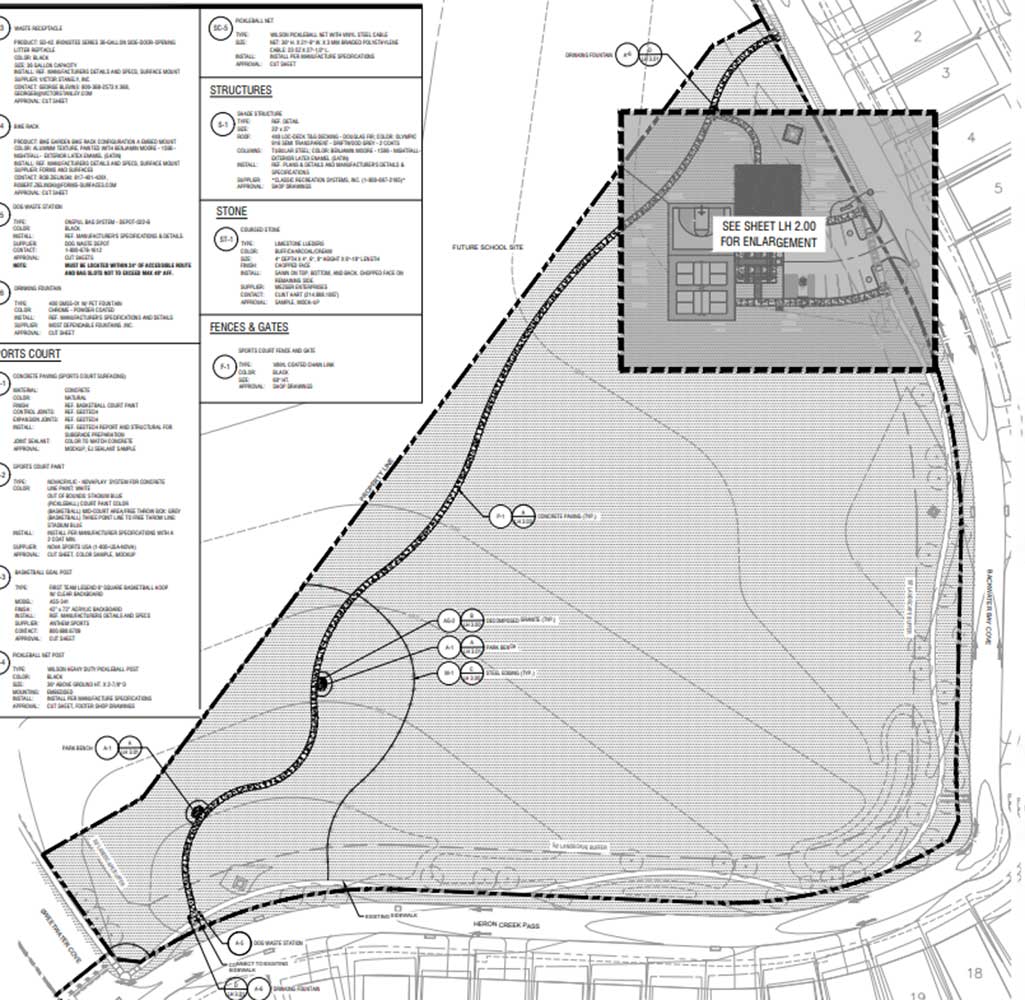

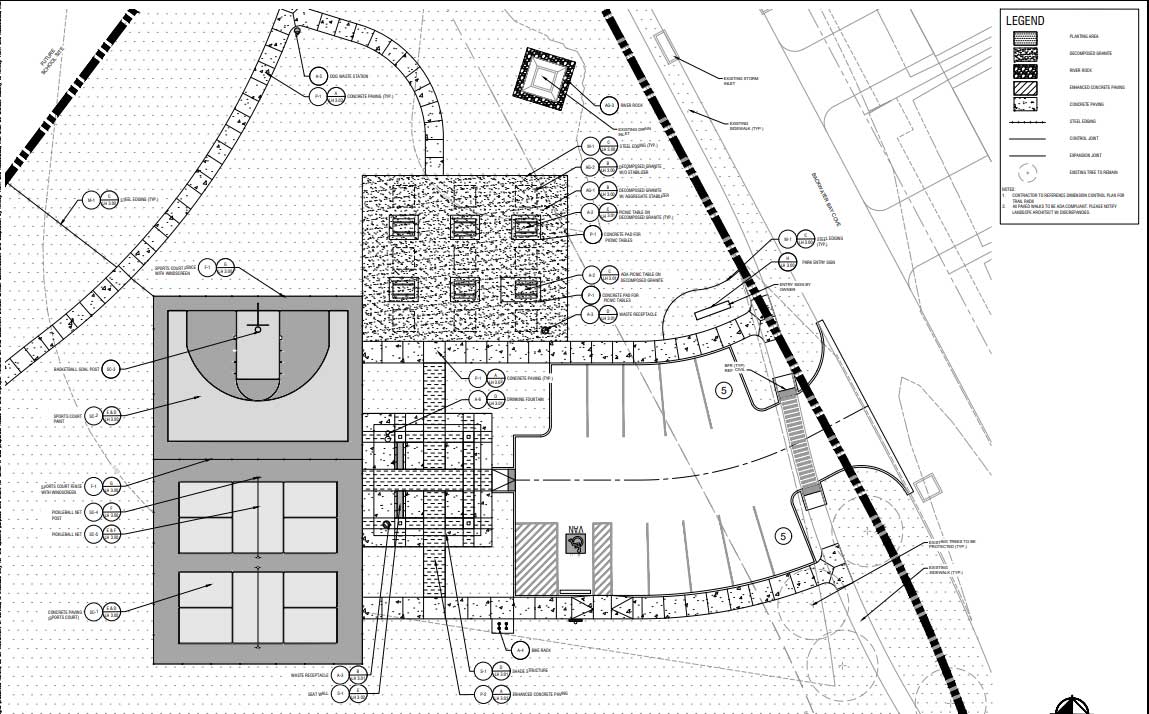

PU3 School Park (Location highlighted green on map)

- Overall Layout Attached (Location highlighted green on map). Plans are in for final review. Working through the bidding process.

Melissa Road (Location highlighted red on map)

- The Bridge/Road contractor has remobilized. The revised estimated completion date is Summer 2024 (Location highlighted red on map)

Gold arrows point to new lots being developed. Green arrow points to the School Park and red to Melissa Road

Concept Plan for Park Area 6 (Location highlighted in blue on map)

Please see the original concept below or click here to download.

To request emergency water turn-off or to report a water meter leak, water main break, fire hydrant leak, or clogged or overflowing wastewater main, call the City of McKinney at 972-547-7360

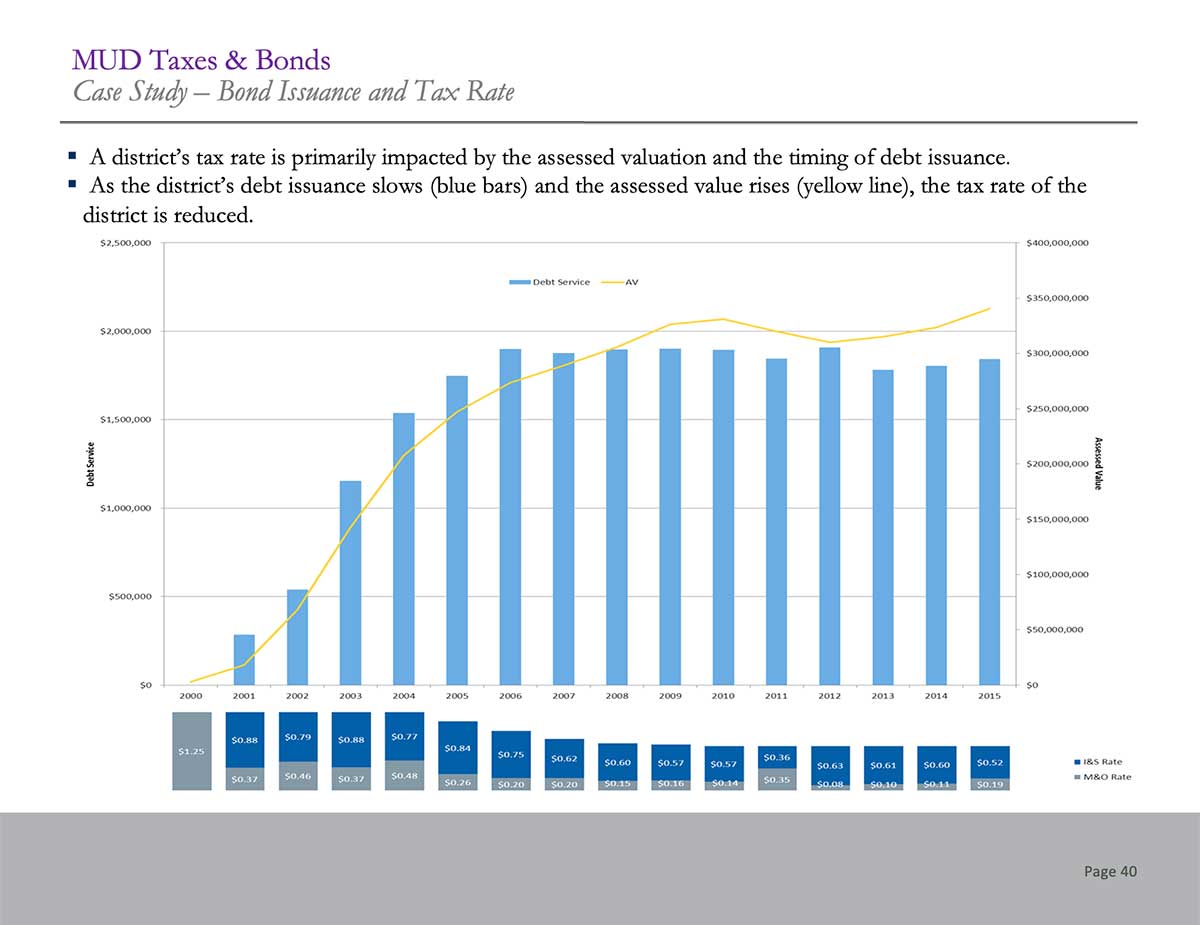

About MUD Taxes:

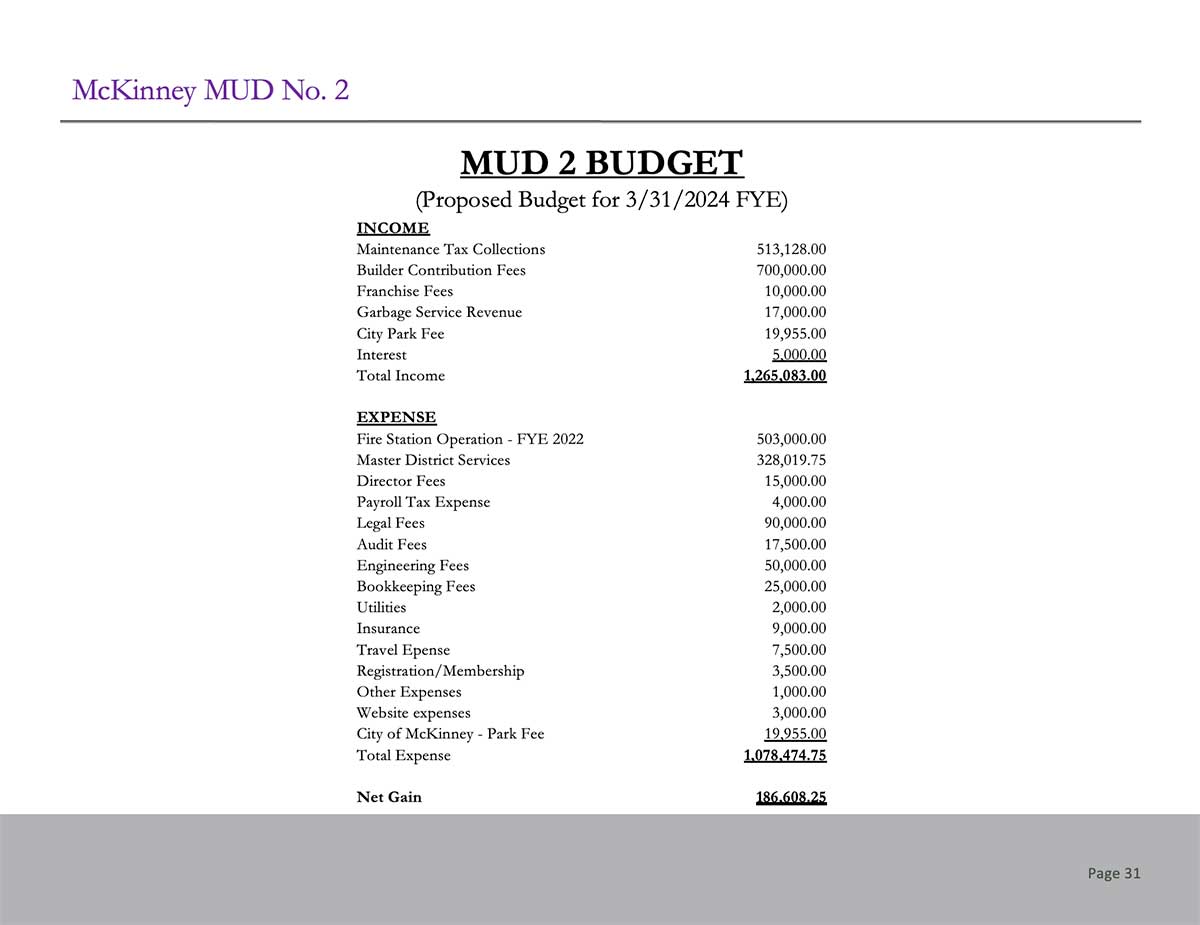

In addition to a debt service tax, MUD 2 levies an annual operations and maintenance tax to pay the on-going expenses of the MUD. These expenses in include payments to Collin County for police protection, payments to the City of McKinney for fire protection, maintenance costs for the roads, sidewalks, and streetlights in MUD 2, and MUD 2’s pro-rata share of the costs to operate and maintain BB Owen Park.

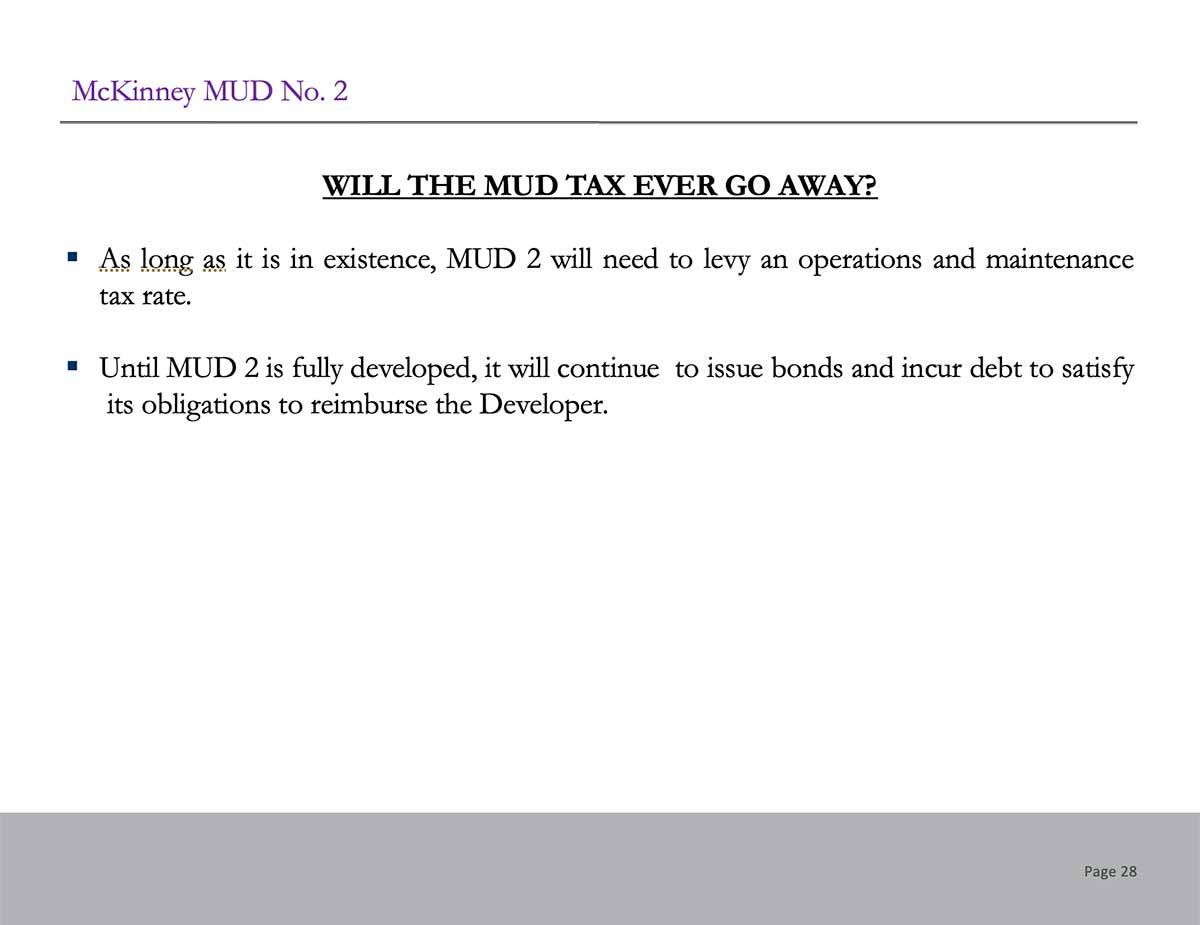

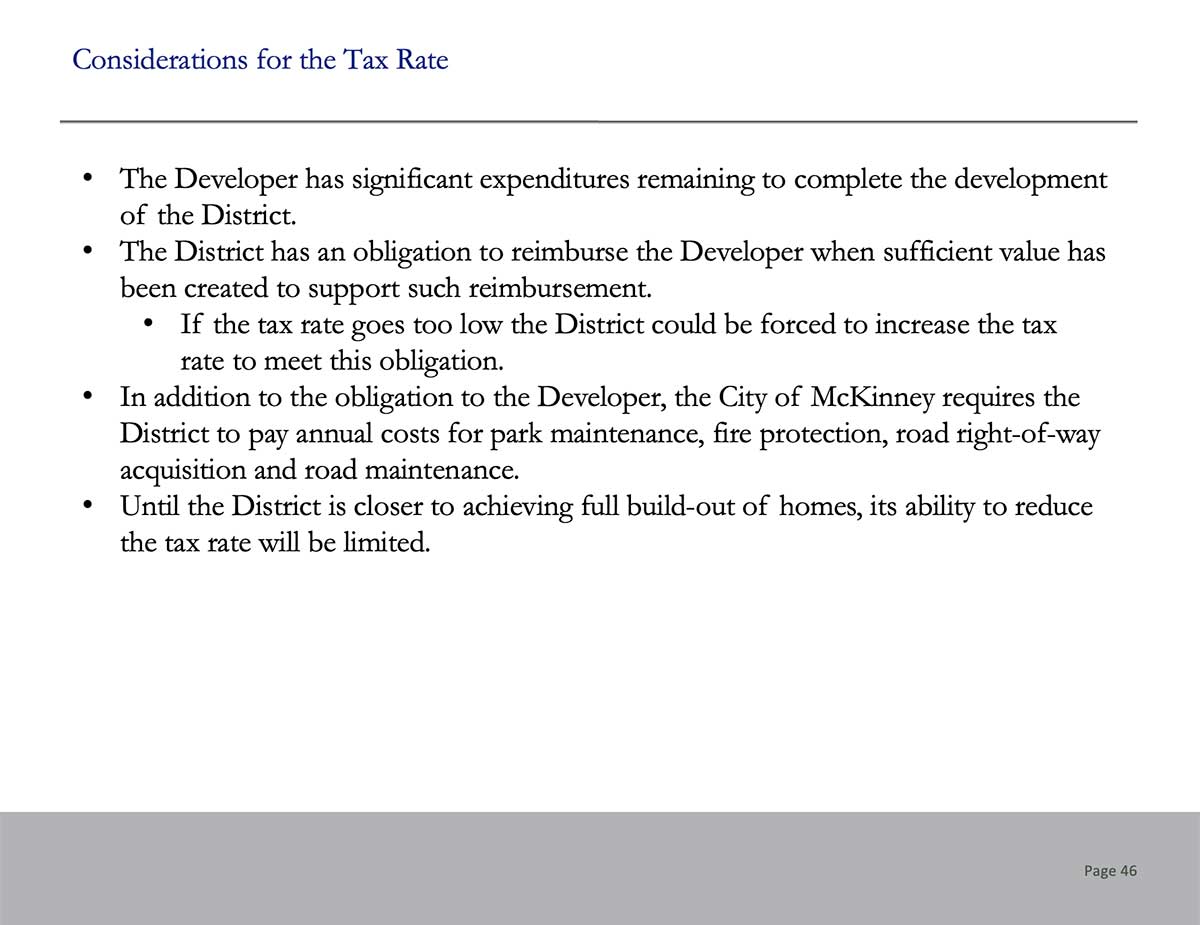

Typically, the bonds issued by a MUD have a twenty-five (25) year maturity. As the debt decreases, MUD taxes may also decrease over time. However, for as long as it is in existence, MUD 2 will need to levy an operations and maintenance tax rate.

Until MUD 2 is fully developed, it will continue to issue bonds and incur debt to satisfy its obligations to reimburse the Developer.

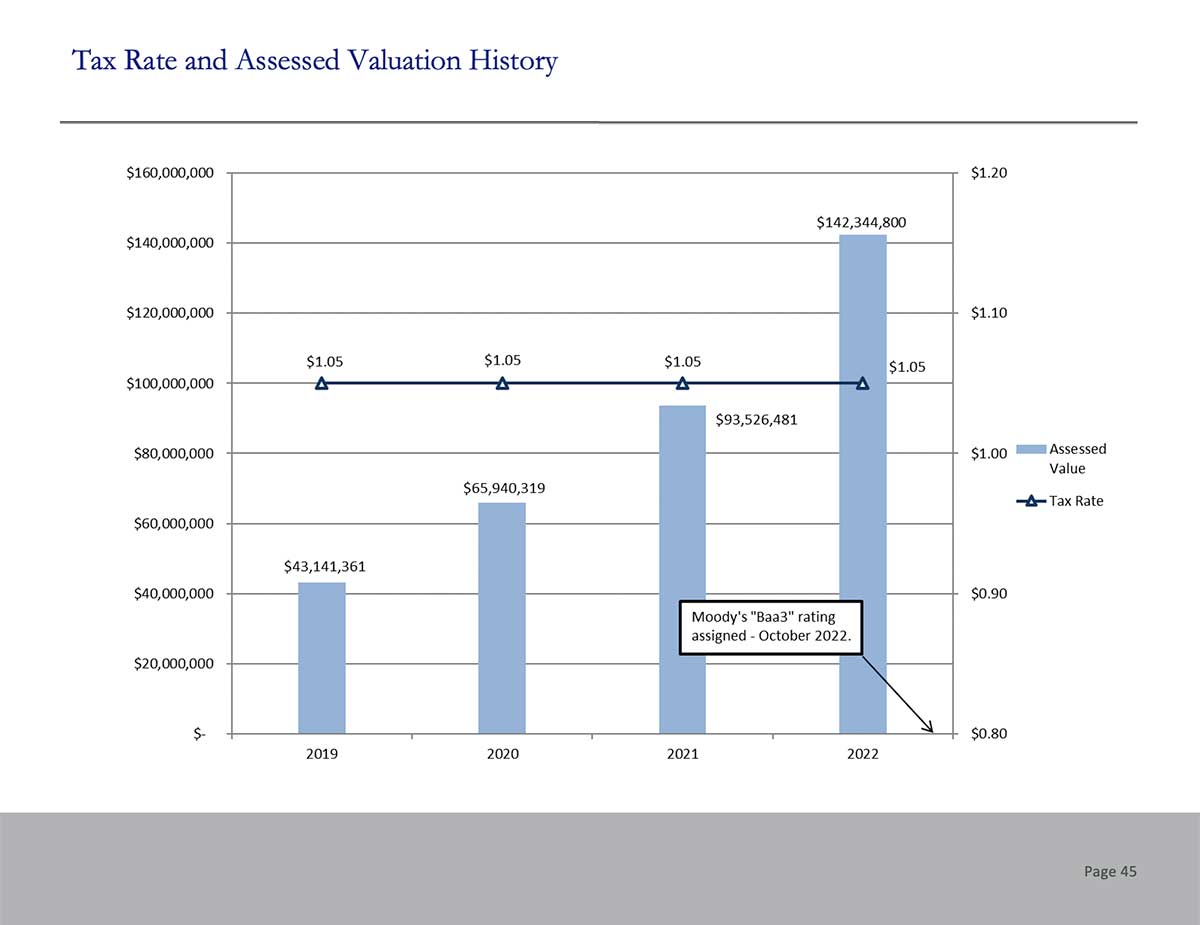

As stated above, the current MUD 2 tax rate is calculated a $1.05 of the taxable value of your property. ($1.05 per $100.00 of taxable valuation.) The taxable valuation of your property is determined by the Collin County Appraisal District – NOT the MUD. MUD taxes, like all property taxes, vary according to values and debt requirements of the taxing entity. As the MUD is built out, operating and debt service costs are shared by more homeowners. As a result, MUD tax rates may generally decline over time.

To answer the question “will my tax bills be higher in a MUD?” – In the short term, yes. When compared to the property tax rate in the City of McKinney, MUD 2 taxes are higher at this point.

Currently, MUD 2 does not offer tax exemptions for individuals who are sixty-five (65) years of age or older.

For more tax information contact:

Utility Tax Service, LLC

11500 Northwest Freeway, Suite 150

Houston, Texas 77092

Phone: 713.688.3855

Each year in January or February, the MUD 2 Board of Directors will consider (based on the recommendation of its Financial Advisor) whether to adopt a tax exemption for the upcoming tax year.

A residential homestead exemption removes part of the value from the assessed value of your property and lowers your property taxes.

Do all homes qualify for a homestead exemption?

No. Only a homeowner’s principal residence qualifies. To qualify, a home must meet the definition of a residence homestead. The home’s owner must be an individual (for example: not a corporation or other business entity) and occupy the home as his or her principal residence. on January 1 of the tax year.

What qualifies as a homestead?

A homestead is a structure (including a condominium or a manufactured home) that is designed and occupied for use as a residence. A homestead can include up to 20 acres of land if the land is owned by the homeowner and used for residential purposes.

Can I qualify for a homestead exemption if there are other owners other than my spouse listed on my property?

Yes. However, if you qualify for a homestead exemption and are not the sole owner of the property to which the homestead exemption applies, the exemption you receive is based on the interest you own. For example, if you own a 50 percent interest in a homestead, you will receive one-half, or $7,500, of a $15,000 homestead offered by a school district.

How do I apply for exemptions?

Applications are available through the Collin CAD Customer Service department and may be picked up between 8:00AM and 4:00PM, M-F. You may have an application mailed to you by calling our Customer Service Department at (469) 742-9200 or on the Collin CAD website at CLICK HERE TO DOWNLOAD THE FORM.

When should I file an application for a homestead exemption?

Generally, you should file your exemption application between January 1 and April 30. However, a recent law change included Homestead Exemptions to the time for filing Over 65 or Disabled Person Exemptions.

If you turn 65, become totally disabled or purchase a property during the current year, you can apply to activate the Homestead, Over 65 Exemption or Disabled Person Exemption for that year. You have one year from the date you qualify to apply for the exemptions for the tax year you first qualified. For example, if you turn 65 during the year you have until your 66th birthday to apply to receive the exemption for the tax year in which you turned 65.

What if I miss the deadline for filing for a homestead exemption?

You may file for a homestead up to one year from the date the taxes became delinquent for that tax year.

Do I apply for homestead exemptions annually?

Only a one-time application is required unless a re-application is requested by the chief appraiser. A new application is required when a property owner’s residence homestead is changed.

What is a Homestead Cap?

Cap value applies to residential homesteads only and it goes into effect the second year after a residential homestead exemption has been granted for your residence. If the property is your residence homestead, the appraised value may not exceed the sum of:

10 percent of the appraised value of the property for the preceding tax year; plus the appraised value of the property for the preceding year; plus the market value of all new improvements to the property.